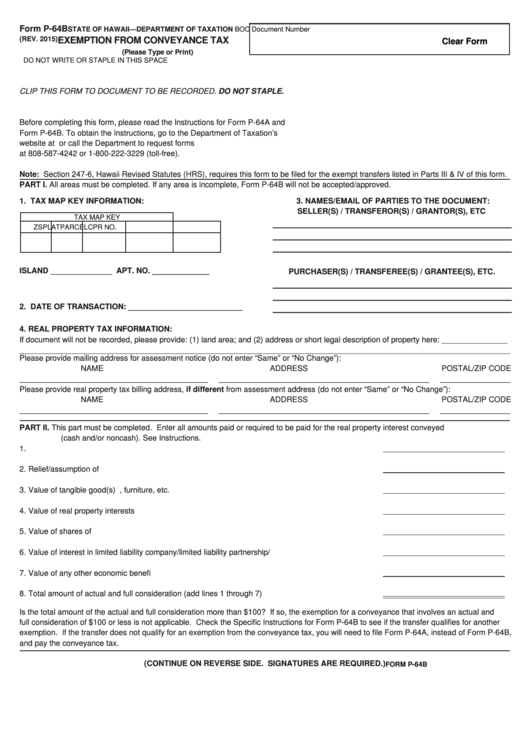

In the case of real estate property transfer, this tax burden usually falls on the seller, but each state can specify (or not specify) whether the buyer or seller will pay. When property is transferred from one party to another, many states and local municipalities levy a transfer tax as a percentage of the value being transferred. How Much Are Real Estate Transfer Taxes in Hawaii (and Who Pays Them)? Keep in mind that these rates apply to the entire sale price, not just the capital gains realized. Similarly, HARPTA requires a withholding of 5% of the sales price when property is sold by an out-of-state resident. FIRPTA, or Foreign Investment in Real Property Tax Act, is a law that requires withholding of 15% of the sales price when property is sold by a foreign national.

Hawaii also has regulations that apply to real estate investors in the state: FIRPTA and HARPTA. That means that if you are single and sold one house for $250,000 of profit last year and then sell your current home for another $250,000, you will be taxed on all the profit from your most recent sale. There is one stipulation when it comes to claiming this tax break: you cannot exclude capital gains from another home sale within the past two years. If you are married, the first $500,000 in profit is tax free. However, if your home appreciated in value since you bought it, you may need to pay capital gains taxes on your annual tax return.Ĭurrently, if you are single and you’ve lived in the house for at least two out of the last five years, then the first $250,000 of profit is exempt from taxation. Sales tax is not applied to property sales on either a federal or state level. Will You Have to Pay Taxes When You Sell Your Home in Hawaii?

We’ll also give you some tips to lower your tax exposure no matter what side of the market you’re on. In this article, we’re going to go over the Hawaii real estate taxes you’ll need to pay when either buying or selling a home in the Aloha State. While US tax law is filled with many subtleties and nuances that can be confusing to homeowners and tax professionals alike, there are three main types of taxes to be aware of: capital gains tax, real estate transfer tax, and property taxes. Real estate is no exception to this rule. If there’s one thing you can know for sure in this life, it’s that you’re going to be paying taxes.

0 kommentar(er)

0 kommentar(er)